An Open Letter to Ray Dalio re: Bitcoin (Part 1)

An open letter to hedge fund colossus Ray Dalio regarding his worldview, the forces of financial nature, and how Bitcoin is bound to reshape both.

Introduction to the Open Letter

Ray, your ability to penetrate the opaque realm of economics and share its secrets in an easy to understand language is one of your greatest gifts to humanity. With your videos, openly published research, and authorship, you have opened the eyes of many to a topic most consider too difficult to comprehend. The world needs more pioneers like yourself writing easy-to-read maps for the nearly incomprehensible territory of economics. Macroeconomists, Academics and Central Bankers rely heavily on deceptive language and universal public ignorance to perpetrate their schemes; your work in converting this esoteric domain into a more exoteric form is therefore commendable.

Let me begin by saying that, like you Ray, I consider myself a “dumb shit” who is more focused on dealing with what I don’t know rather than relying on what I do know to navigate life and work — a mindset well accorded with ancient wisdom:

“All I know is that I know nothing.” — Socrates

Epistemic reach is finite, as knowledge cannot explain everything in the world and, often, it clouds the truth. So let us explore the territory of economics with a beginner’s mind, free of the accumulated clutter commonly called “conventional wisdom”. It is from this frame of mind that I present to you this open letter regarding your perspective on Bitcoin through the lens of your stated principles on life and work (in this letter, I sometimes direct my comments at Ray, and sometimes at the audience, so please bear with these shifting perspectives).

We begin with an evaluation of Ray set in the idea-meritocratic style practiced at Ray’s firm, Bridgewater. The purpose of these evaluations is to grade your peers candidly, being brutally honest and holding no punches, to ensure that the best ideas rise to the surface — unimpeded by policy, politics, or hierarchy — so that they may be scrutinized and, if useful, acted upon. In Bridgewater’s culture, communication is both top-down and bottom-up, so that people feel empowered to share their honest perspectives. For Ray, it’s all about getting to the truth by any means necessary, and I appreciate his blunt approach. We will explore all of this more deeply below — so let’s dive in.

Open Letter to Ray Dalio re: Bitcoin

Subject: Ray’s Assessment of Bitcoin

From: Robert Breedlove

To: Ray Dalio

Cc: Everyone

Attachment 1: Ray’s assessment of Bitcoin available here —

Attachment 2: Robert Breedlove on The Pomp Podcast #233—

Ray,

You deserve an “F” for your assessment of Bitcoin’s significance and future prospects. Although there are very few of us, everyone who has the requisite depth of understanding in the fields of computer science, monetary history, game theory, economics, and mathematics, and has spent the time intensely studying Bitcoin (it takes a lot), agrees with this harsh evaluation of your short-sighted assessment of this momentous monetary innovation. As one of your biggest fans, I truly believe that if you take another look (a long, hard, thoughtful look), you will see the light. Specifically, your assessment fails for the following three reasons:

1. You claim that you are sold “blockchain technology”, despite the only proven use case for “blockchain technology” is as a component of Bitcoin. Contrary to “conventional wisdom”, the real breakthrough is Bitcoin, not blockchain.

2. You state that Bitcoin could be disrupted by another “cryptocurrency”, however this extremely unlikely: Bitcoin is a path-dependent, one-time invention; its critical breakthrough is the discovery of absolute scarcity — a monetary property never before achieved by mankind. The emergence of Bitcoin cannot be reproduced because absolute irreproducibility is the discovery! The iPhone disrupting Blackberry analogy you cite is irrelevant; Bitcoin is a protocol, not a consumer product.

3. You state that price-stable, central bank issued currencies will be issued, which will likely be attempted, but such currencies would be antithetical to free markets. Further, price stability is an illusion: all economic goods move against one another in ratios of exchange, money is simply the most marketable good, hence the reason money-denominated exchange ratios (prices) tend to be more stable, but are still subject to supply and demand interaction. Since Bitcoin is absolutely scarce and cannot be stopped, it is likely to continue outcompeting all other monetary technologies on the free market. As an economic good monetizing in real time, the exchange ratios between Bitcoin and various fiat currencies is likely to remain volatile for some time, but this volatility will continue to subside as Bitcoin’s market capitalization grows, thus making its use as a medium of exchange more practical, before reaching a point of sufficient network value where prices will come to be more commonly expressed in Bitcoin terms (similar to the evolutionary phases gold underwent during its monetization process).

Your assessment is especially disappointing for three reasons: 1) You have consistently exhibited a knack for comprehending, distilling, and communicating highly complex economic concepts in a manner palatable for general audiences, 2) The depth of knowledge you possess in history, economics, and free market dynamics presents you with a privileged position to best understand the emergence of and demand for this asset, and 3) Your virtually unparalleled reach and reputation as a macroeconomic thought leader, organizational engineer, and cultural innovator is an invaluable platform from which to trumpet to the dire circumstances faced by the prevailing economic order and how Bitcoin has the potential to alleviate them.

In the following open letter, I will show that the fundamental tenets of your worldview, as stated in your book Principles and other writings, are fully consistent with Bitcoin — even though you may not yet realize it. I’ll begin with two primer sections: one on the nature of money and its history, and one on Bitcoin’s general functionality and economic properties — either or both may be skipped by the reader who has “already fallen down the Bitcoin rabbit hole”, so to speak. After these primers, I will walk through many of Ray’s most important Principles, one by one, and break them down to better understand their relationship to markets and Bitcoin. Let’s begin.

Primer on Money*

*(this Primer on Money and the following Primer on Bitcoin may be skipped by the reader who understands the traits of money and Bitcoin’s general functionality/economic properties)

Money is a tool for moving value across time and space (or spacetime, as Einstein explained, these are actually one in the same). Money is an emergent property of barter (or direct exchange) that purports to solve the three dimensions of its non-coincidence of wants problem; it evolves naturally in the free market as the most exchangeable good in an economy. Although he is silent as to its origins, Ray understands the technological functions of money, as he stated in his video assessment of Bitcoin (see open letter attachment above) that the primary functions* of money are:

1. A store hold of wealth: also called a ‘store of value’ in regard to moving value across time (the first function and evolutionary phase of money)

2. A medium of exchange: in regard to moving value across space (the second function and evolutionary phase of money)

*We will ignore for now the third function and evolutionary phase of money, unit of account, as it isn’t pertinent to our discussion here.

Although the purpose of money always remains the same, to move value across spacetime, the technology fulfilling this purpose is constantly being subjected to market-driven evolutionary pressures. The greater a monetary technology’s resistance to value dilution across time — whether by counterfeiting, supply inflation, or deterioration — the more effective it is as a store of value. Once a store of value accrues enough value, people begin to use it for trading purposes. The more widely accepted a form of money is, the higher its value as a medium of exchange, which makes this aspect of its value proportional to the number of its monetary network participants (aka users). When a specific monetary technology, in the form of an economic good, becomes widely accepted in interpersonal exchange (aka trade) it is called “money”. Monetary technologies compete to become more widely adopted based on the following traits:

1. Scarcity: resistance to money supply manipulations and, thus, dilutions to its monetary unit value (difficult to produce)

2. Divisibility: ease of accounting and transacting at various scales (separable and combinable units)

3. Portability: ease of moving value across space (high value-to-weight ratio)

4. Durability: ease of moving value across time (resilient to deterioration)

5. Recognizability: ease of identifying and verifying the monetary value by other parties in a transaction (universally identifiable and verifiable)

Due to the relative advantages competing monetary technologies offer, the particular economic good being used as money can, and does, change over time. Throughout history, mankind has employed seashells, salt, cattle, precious metals, and government paper as money, to name a few. Similar to the price discovery process in a free market — where the collective actions of buyers and sellers are continuously compressed into a single actionable variable called the market price — competing monetary technologies undergo a market-driven discovery process. We can gain a better understanding of this dynamic through an analogy: monetary evolution is (roughly) comparable to the evolutionary process we see in communications technologies.

No matter what specific means is used to fulfill it, the purpose of communications technology remains the same: to move information across spacetime. Similar to the market for money, competition is at all times alive among different communications technologies, in which they are all subjected to a market-driven discovery process. As newer technologies are invented they are market-tested through competition; each survives or dies in terms of its relative speed, message fidelity, reliability, traceability, and mobility. Since these technologies have a singular purpose, people tend to adopt a common technology, a coalescent process that is propelled by network effects.

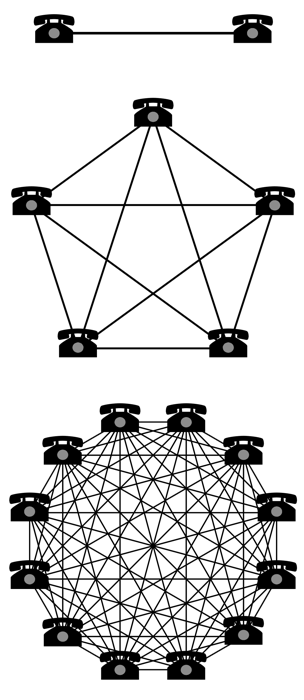

Network effects, defined as the incremental benefit attained by adding a new member to a network for all of its existing participants, drive people to adopt a primary form of communications technology. As more people migrate to the latest and greatest technology, it encourages others to do the same, as more network participation exponentially increases the number of possible connections. A simple example of this is the telephone: with two phones in existence, only 1 connection is possible; with five phones in the network, the number of connections jumps to 10; and with twelve networked phones, the number of connections increases exponentially again to 66, and so on. (see Metcalfe’s Law for a directional explanation of this network effect dynamic):

Since the purpose of communications technology remains singular (moving information across spacetime) despite technological advances, whichever technology is best at fulfilling this purpose has a tendency to become dominant in the marketplace. This tendency, reinforced by network effects, has driven communications technology evolution from carrier pigeons to telegraphs, to the internet today. This is an expression of the winner-take-all (or, winner-take-most) dynamic inherent to many networks, including those of the communications and monetary technology varieties.

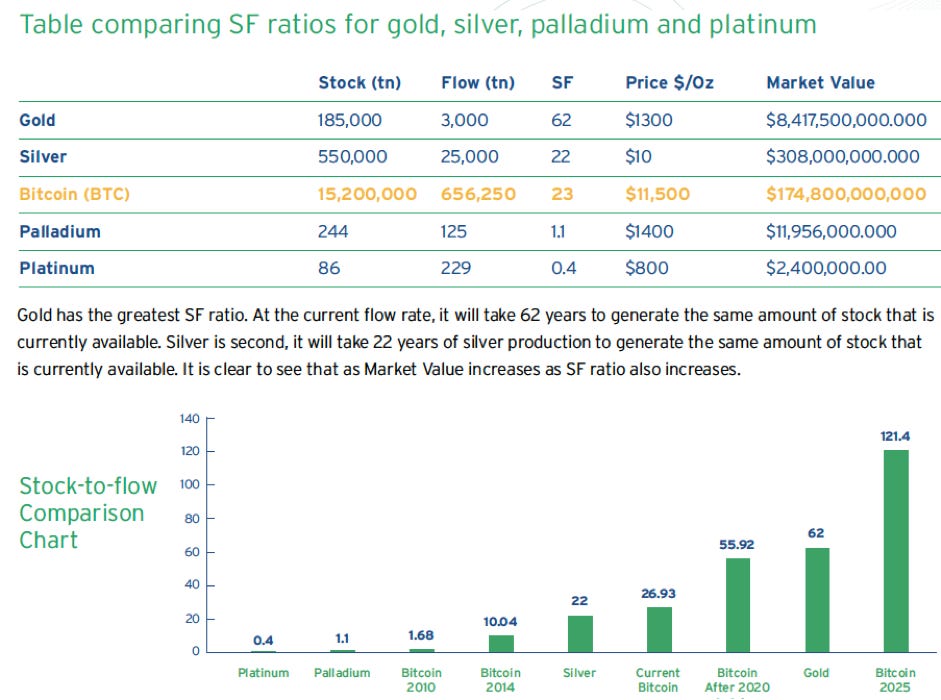

Similar to the purpose of communications technology, the purpose of monetary technology is singular: to move value across spacetime. The various monetary technologies used to fulfill this purpose, however, undergo market-driven discovery and, thus, evolve over time based on their respective monetary traits. In respect to the traits of money, the one that takes primacy in determining a specific monetary technology’s likelihood of success in the free market is its hardness (also called the scarcity or soundness of money). This trait is of primary importance because it determines a money’s usefulness as a store of value, and a money that cannot adequately store value across time necessarily cannot transmit value effectively across space. The relative hardness, or scarcity, of a competing monetary technology is quantified by its stock-to-flow ratio, a valuation metric also common in precious metals markets such as gold:

· Stock is the existing unit supply of monetary units (for example: ounces of gold, quantity of US Dollars, or quantity of Bitcoin)

· Flow is the newly created supply over a specific time span, usually one year

· The stock-to-flow ratio is calculated by dividing the stock of monetary units by its newly created supply flow (can be thought of as the inverse of inflation)

· The higher the stock-to-flow ratio, the greater the hardness (also called soundness or scarcity) of the monetary technology

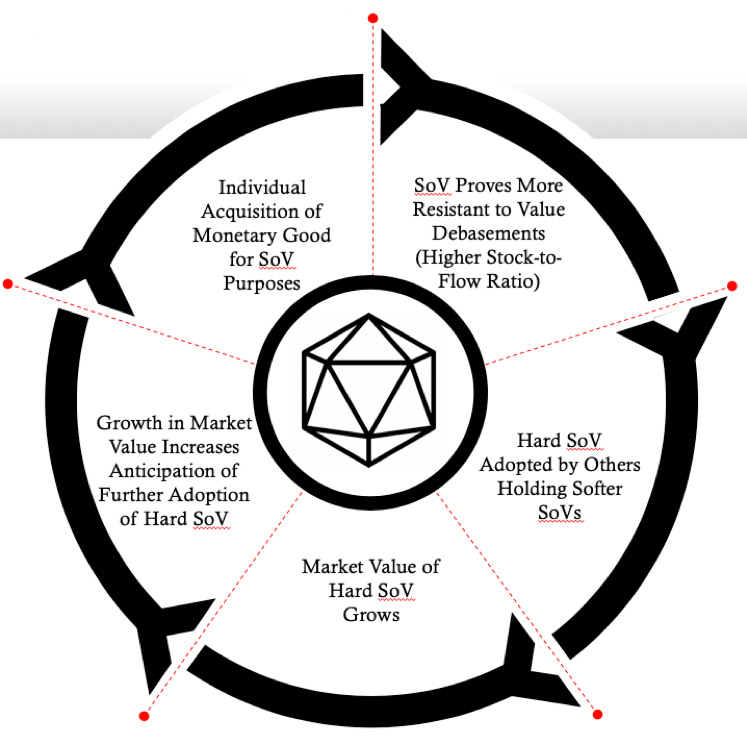

We can think of monetary hardness as the difficulty (or cost) necessary to produce an incremental unit of a monetary technology. For instance, the capital and operational expenditure necessary to extract an ounce of gold from the ground is the basis of its monetary hardness. As producers of gold will always seek to extract it until their incremental cost per ounce is equal to their incremental revenue per ounce (in other words, until marginal cost equals marginal revenue), there is a perpetual financial incentive for producers to maximize new supply flows up to the point of economic breakeven. In comparison to communications technologies, money exhibits much stronger centripetal, winner-take-all network effects that drive users to adopt a single store of value. Those who fail to adopt the hardest money available to them face a debasement of their stored value by those who can produce it at an incremental profit (where MC<MR). Hard money, then, is simply the monetary technology freely selected in an unobstructed marketplace as the most sound store of value available. Historically, gold prevailed as hard money precisely because of its superior stock-to-flow ratio relative to other monetary metals:

On the free market, people naturally and rationally choose to store the value created by their work in the monetary technology that is hardest to produce, since producing new units dilutes the value of existing units for all holders of said money. Since gold exhibits superior monetary hardness, it has outcompeted silver and other monetary metals several times throughout history. Gold outcompetes due to the game-theoretic aspects of an evolving store of value:

Since gold is virtually indestructible, nearly every ounce mined throughout human history remains part of its extant supply; and since gold is relatively rare in the Earth’s crust, its new supply flows are a small percentage of its existing stock each year. Taken together, these properties give gold the highest stock-to-flow ratio of any monetary technology in the world (before Bitcoin), meaning that its supply inflates at a relatively low and predictable rate. Superior hardness is precisely why gold became the dominant monetary technology on the free market.

Game theory tells us, and market history proves, that anyone who can, for instance, profit from silver production by selling it at a higher price than it cost to produce, has a direct financial incentive (the protection of value across time) to store any profits generated in the hardest form of money available to them. As all market participants are subjected to this harsh economic reality, this persistent incentive triggers investment flows from silver (or any other softer monetary technology) to gold (or the hardest form of money available). In this way, free market competition causes people to converge on a single store of value and, therefore, perpetually promulgates hard money. This is not surprising, as free markets tend to zero in on the best possible technological solutions to problems, discarding the rest. And conceptually, in the same way that money is an emergent property of a direct exchange (barter) economy, hard money is an emergent property of an indirect exchange (monied) economy.

The physicality of gold gives it both advantages and disadvantages. Being a precious metal that achieved its monetary value on the free market, gold is a self-sovereign monetary technology, meaning that its value, trust factors, and transactional permissibility as money are not subject to any counterparty risk whatsoever. In other words, gold is equity-based money or a bearer asset. If someone flips you a gold coin and you stick it in your pocket and walk away, then you have just participated in an irreversible transaction. The value of this coin is set by the market and whosoever is in physical possession of it is assumed to be its rightful owner. No bank or payment intermediary can censor or reverse this free market transaction. You have no need trust anyone else, whether you choose to hold or spend your gold. Self-sovereignty is a quality uniquely intrinsic to bearer assets such as gold, silver, or diamonds.

Contrarily, if someone hands you a US Dollar, you assume the counterparty risk of the US Government, who can dilute its value via supply inflation (as we see with all fiat currencies throughout history) or deauthorize its value altogether (as we saw when India deauthorized its 500 rupee bank note). Further, if you received this US Dollar through a payment intermediary, like Paypal or Venmo, you are also exposed to the risk of this payment being censored, reversed, or surveilled. Even when physically hoarding fiat currency, it is still vulnerable to supply inflation as its central bank backer can simply print more, stealing the value stored therein. By transacting in anything other than a bearer asset, which is valued solely based on free market dynamics, you forfeit your personal financial sovereignty to the currency issuer and/or other financial intermediaries.

Although gold’s physicality gives it the property of self-sovereignty, it also comes with inherent disadvantages. Its primary drawback is its suboptimal divisibility. Since gold has such high value to weight, it is impractical to pay for coffee using gold coins, for instance. This drawback of gold is what gave silver some utility as a medium of exchange throughout history, as its value to weight was much lower making it more practical to use for everyday purchases (due to its higher divisibility and portability), whereas gold was typically reserved for settling large transactions.

Eventually, gold’s divisibility problem was “solved” when central banks which began issuing paper currencies which were fully redeemable for gold. This provided users with a hybrid monetary technology that exhibited the hardness of gold, while offering an ease of transactability (high divisibility and portability) even greater than that of silver. With its marginal utility disrupted by paper currencies (and later, electronic abstractions of paper currencies), silver became completely demonetized and eventually the entire world market for money evolved to a paper-currency-enabled gold standard.

With transactions being executed in gold-backed paper currencies, the global gold standard led to the centralization of gold within bank vaults. These gold hoards became too tempting for governments and their central banks to resist expropriation of, thus catalyzing the fractional-reserve banking practices now ubiquitous in the modern world economy. As governments created more currency units than they could support with their gold reserves, they started revoking currency redeemability for gold, which culminated in the 1971 unilateral decision by US President Nixon to permanently sever the peg to gold (deceivingly, it was declared to be a temporary measure):

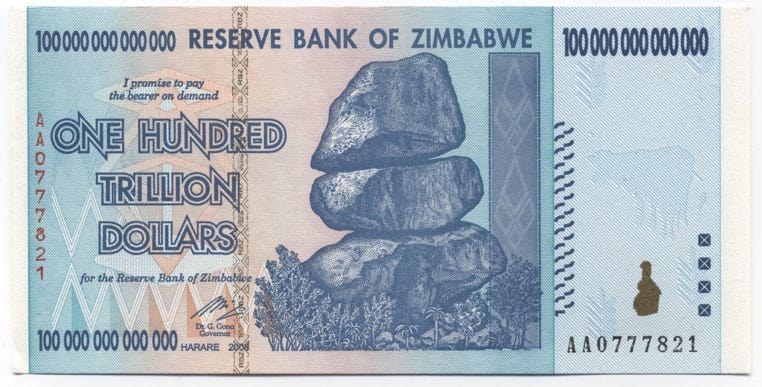

Since all other currencies in the world were pegged to the US Dollar, this final act of financial sovereignty usurpatioficially abolished the gold standard worldwide. This death-stroke to monetary integrity brought us into the age of the “political debt-based money backed by the future cash flows of taxing authorities” we all are legally coerced into using today — fiat currency. With fiat currencies came the limitless inflation suffered episodically all over the world. Inflation comes to us from the Latin verb inflare meaning “to blow up”. This is an apt description since once it sets in, fiat currency inflation has only one possible outcomdilution into worthlessness:

Since breaking its peg to gold, the US dollar has lost over 97% of its relative value. The fiat currency printing press has proven to be the weapon of choice for political leaders to further their agendas and enrich themselves; it has also become the primary means for funding perpetual warfare. During the past century of central banking — which cunningly imposed its dominion over a large swath of the world’s gold supply through coercion and confiscation — there has been unprecedented per capita death in warfare, an ever-widening wealth disparity, and an incessant sequence of economic boom and busts fueled by the continual marginalization of paper currencies and, ultimately, the instantiation of fiat currencies. Today, all semblance of monetary integrity and sanity has been destroyed with citizens left optionless, forced to transact in softest form of money in history.

In the wake of the latest (and arguably the greatest) fiat-currency-fueled economic bust, the 2008 Great Recession, when central banks all over the world were busy printing more fiat currencies to recapitalize their financial institutions via the shadow tax of inflation, Satoshi Nakamoto released an open-source software project into the world. He, she, or they called it Bitcoin.

Part 2 will go into a primer on Bitcoin. Later in the series, Bitcoin and money will be explained through the lenses of Ray’s individual principles on work and life.

Well written and well researched. Worth the read and listening yo the pod cast.

Excellent summary. Looking forward to part 2!