An Open Letter to Ray Dalio re: Bitcoin (Part 4)

An open letter to hedge fund colossus Ray Dalio regarding his worldview, the forces of financial nature, and how Bitcoin is bound to reshape both.

Part 3 left off with an analysis of the idea meritocracy, its formulaic elements, and the comparative free market formulation. In Part 4, we continue the exploration of Ray’s principles, using them as lenses through which to view Bitcoin and money.

Open-Mindedness

(p. 187) “If you can recognize that you have blind spots and open-mindedly consider the possibility that others might see something better than you — and that the threats and opportunities they are trying to point out really exist — you are more likely to make good decisions.”

Open-mindedness is a key aspect of both an idea meritocracy and evolution. It is a concept closely related with filtering and optionality: a form of non-cognitive intelligence intrinsic to natural systems in which exposure to multiple potentialities is employed, allowing the system to “learn” by adopting what works and discarding what doesn’t. An interesting paradox is discovered in that this openness is the source of Mother Nature’s opaque logic — as Taleb puts it:

“Evolution proceeds by undirected, convex bricolage or tinkering, inherently robust, i.e., with the achievement of potential stochastic gains thanks to continuous, repetitive, small, localized mistakes. What men have done with top-down, command-and-control science has been exactly the reverse: interventions with negative convexity effects, i.e., the achievement of small certain gains through exposure to massive potential mistakes…Simply, humans should not be given explosive toys (like atomic bombs, financial derivatives, or tools to create life)”

Close-mindedness, on the other hand, represents a rigid fixity on an existing knowledge framework that excludes the possibility of learning, innovation, and evolution. Without a culture of open-mindedness, organizations fail to learn and adapt well, and begin to suffer losses at the hands of more fit competitors. Sheltered from market discipline by legally fortified monopoly positions, central bankers become feeble minded while, at the same time, their monetary technologies become brittle and maladapted to shifts in user demand.

Open-mindedness is an ever-present state of mind, a keen awareness of optionality and the freedom to filter; to change one’s mental or organizational model, to reform one’s prior assessment of conditions based on new information or a new vantage on old information (Bayesian inference).

Here, we see another perspective on the ineffectiveness of central planning — by moving in accordance with a single, rigid plan of action, the economy gets locked into a non-opportunistic course of action; it becomes blind to optionality and, thus, close-minded. For institutions, innovations, and individuals, close-mindedness is fatal. As legendary physicist Richard Feynman said, “we can never be sure we’re right, we can only be sure we’re wrong” — this is why open-mindedness matters across all spheres of human action.

Open-mindedness in the technological realm is manifests in the form of open-source technologies; tools sporting schematics that anyone can inspect, modify, or enhance. Ray incorporates this principle into his culture at Bridgewater and in the “management tools” his team uses to make organizational and investment decisions. Bridgewater’s management tools are open-source by design so that they can consistently adapt to offer the highest utility to its workforce. As Ray says, (p.527) “Because the thinking behind the algorithms is available to everyone, anyone can assess the quality of the logic and its fairness, and have a hand in shaping it.” By applying the principle of radical transparency to his management toolset, Ray encourages a culture of open-mindedness by making their tools open to critique and change, in the same way ideas are assessed openly based on their merits alone within his cultural paradigm. This approach ensures that everyone maintains a perspective of “why are we doing it this way” and “is the tool helping us achieve our objectives as an organization”.

Essentially, by practicing open-mindedness, the team at Bridgewater supports their effort to operate as an idea meritocracy. In effect, Bridgewater has structured itself as an open-source organization in which its team learns and grows by, (p. 67) “Wrestling with the markets, thinking independently and creatively about how to make our bets, making mistakes, bringing those mistakes to the surface, diagnosing them to get at their root causes, designing new and better ways of doing things, systematically implementing the changes, making new mistakes, and so on.” Whether you realize it or not Ray, you have been cultivating a culture based on the ethos of open-source technology.

Open-source technology is readily inspectable and, therefore, trust-minimized. Openness lets it absorb feedback from many sources to adapt in response changing market conditions and user demand. These technologies are absolutely transparent and auditable, which minimizes the need to trust other people when using these tools to interact. Trust-minimization is also one of the primary benefits of that ancient open-source monetary technology — gold. Since trading partners couldn’t necessarily trust each other, they could instead rely on the natural laws restricting the supply of gold and use time-honored techniques for assaying its authenticity (until coinage fulfilled, and later, repeatedly violated this trust function), thus minimizing the need to trust counterparties to a transaction.

Closed-source technology is the reverse and thus requires users to trust in its purveyor; it is unauditable and, therefore, maladapted to market conditions and user demand. In the case of fiat currency, this purveyor is a monopolist and, as many of us learned in Economics 101, profit maximization for a monopolist comes at great expense to everyone else. Fiat currency is closed-source technology that is legally protected from audits and competing monetary technologies. Such opacity and market insulation not only slows the rate of monetary technology innovation, it also erodes the trustworthiness of fiat currency, and fattens its monopolists:

As you’ve said, “Adaptation through rapid trial and error is invaluable” — this is the ethos of open-source. Bitcoin, being open-source, is like a language, as its source code and transaction history are universally transparent and can even be printed onto paper (interestingly, this makes it protected under the First Amendment in the United States). Further, Bitcoin is supported by a global network of volunteer programmers. These programmers are self-interested in the sense that they are almost always Bitcoin owners as they are aligned with its purpose philosophically, and therefore stand to gain financially from its improved functionality and network growth. The work of these open-source programmers closely mirrors Ray’s approach to organization building, in which he creates systems that encourage others to (p.64) “Put honest thoughts on the table, have thoughtful disagreements in which people are willing to shift their opinions as they learn, and have agreed-upon ways of deciding if disagreements remain so that we can move beyond them without resentments”. Again Ray, your approach to culture and management style mirrors the philosophy of open-source technology.

Ray, is there any reason you believe Bridgewater should benefit from open-source tools while society should suffer under closed-source fiat currency? Shouldn’t citizens everywhere have access to the most open and highest quality feature-set for the most important technology in their lives — money?

Bitcoin’s openness is key to its competitive superiority as money. Over the past decade, its global army of volunteer programmers has greatly enhanced the utility of the Bitcoin network. However, and this is critical, these programmers are unable to change the rules of Bitcoin due to its ingenious social contract implementation. Further, since everyone (every node) is “in charge” of the Bitcoin network, it adheres well to Ray’s advice to, “Make sure that those in charge are open-minded about the questions and comments of others.” This constant scrutiny and feedback from users, each of whom has skin in the game and is “in charge”, ensures that Bitcoin is always functioning at or near its optimum. Contrarily, fiat currency has undergone essentially no innovation since its inception.

Due to its open-source nature, Bitcoin is sometimes referred to as “the internet of value”. In the same way the internet is a set of open-source protocols for exchanging data (called the internet protocol suite), Bitcoin is an open-source protocol for exchanging value. Such openness ensures that Bitcoin’s code cannot be manipulated to benefit anyone at the expense of anyone else. Fiat currency is the opposite; its central planners are, at their own discretion and at near-zero cost, able to siphon value from its monetary network by inflating its supply (such “technology backdoors” are only possible with fiat currency). In regards to how to kill Bitcoin, the “internet of value” analogy also gives us the useful comparative question: How would one turn off the entire internet worldwide, permanently? Governments have proven adept at eliminating centralized entities, however the decentralized nature of the internet and Bitcoin in many ways transcend the coercive and compulsory powers of governments (which is why America can’t regulate Bitcoin).

The openness of Bitcoin also makes it antifragile, meaning it becomes hardened by hostility. As you’ve said, “The key to success lies in knowing how to both strive for a lot and fail well.” Open-source, decentralized, digital tools like Bitcoin are uniquely capable of organizing human efforts without a central coordinator at unprecedented scales (strive for a lot) and also become enhanced in the face of technical failings (fail well). Stressors to Bitcoin may come in the form of an external attack on its network or an attempt to fork its blockchain. After 11 years of nearly flawless operation within a relentlessly adversarial environment, Bitcoin has earned its fair share of battle scars (Bitcoin cash, Segwit, etc). Each time Bitcoin withstands an attack, its reputation for network security, reliability, and immutability is strengthened.

Bitcoin is a technology that has accrued value on the free market based on its credibility as money. Unlike fiat currency which persists only because of a government-enforced refugium from competing technologies, Bitcoin persists based on its own merits. Indeed, Bitcoin is a free market for converting electricity into digital gold — it is outcompeting (literal) monopoly monies worldwide and, by doing so, making the market for money free once again (as we saw in the Gilded Age). Similar to the internet outcompeting intranets, Bitcoin is outcompeting fiat currencies because of its superior openness and monetary traits:

As you’ve said Ray, (p.189) “To be radically open-minded, you need to be so open to the possibility that you could be wrong that you encourage others to tell you so.” Unhampered competition incentivizes others to prove you wrong in the marketplace by discovering better or cheaper ways of producing or doing things — this is the very essence of free market capitalism. In truly free markets individuals are maximally sovereign and ruthlessly pursue satisfaction of their wants, which keeps entrepreneurs ever-vigilant in their quest to deliver high quality at a fair price. This unabated pursuit makes free markets generators of quality, innovation, and cost-effectiveness. The reverse is true in monopolized markets — which maximize profits for monopolists at the expense of customers in the form of lower quality (low innovation) and higher prices (market distortions, egregious fees, and value confiscation via inflation).

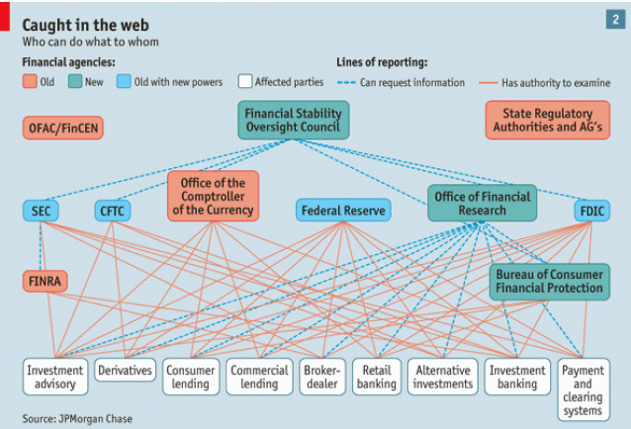

As you’ve said in regard to open-source technology Ray, (p.528) “Though the system won’t be perfect, it is much less arbitrary — and can much more easily be examined for bias — than the much less specified and much less open decision making of individuals with authority.” Here you are describing the value of Bitcoin’s immutable monetary policy, which is totally free of arbitrariness, and its incentive-oriented design (people are incentivized to use Bitcoin, see feedback loop in Primer on Bitcoin) over central bank’s arbitrary monetary policy and disincentive-oriented design (people who attempt to compete with or refuse to use fiat currencies are punished). Further, the institutional web surrounding central bank interests is so complicated and holistically unfathomable, it is more prone to arbitrages by insiders, accumulation of systemic risks, and blow ups:

This messy, closed-source system is bureaucratic, inefficient, and fragile. The main point: open-mindedness is the key to the adaptivity and, thus, the longevity of natural systems. As open-source money, Bitcoin excels in this respect. And money, a long time before government, arose as a natural market phenomenon.

Faith in Nature

(p.140): “Whenever I observe something in nature that I (or mankind) think is wrong, I assume that I’m wrong and try to figure out why what nature is doing makes sense.”

Ray’s introductory observation here is consistent with the wisdom of Taleb, who said, “what Mother Nature does is rigorous until proven otherwise; what human and science do is flawed until proven otherwise.” Clearly, this is a damning indictment of fiat currencies, which are unnatural monies born of unnatural laws. Gold and silver, on the other hand, rose to become natural monies precisely because of natural laws, which are beyond the reach of mankind’s prying hands, and which bestowed them with the traits of good money. Similar to the (mostly) uncompromising rules governing gold, the rules governing Bitcoin are founded in the (absolutely) uncompromising laws of mathematics — nature’s fundamental language:

As you’ve said Ray, (p.141) “nature optimizes for the whole, not for the individual, but most people judge good and bad based only on how it affects them.” This is what’s wrong with putting individuals in charge of money supplies — they are directly incentivized to produce ever-more money and use it to acquire hard assets (like land, gold, and businesses) and pass down the inflationary costs to all other market participants, who are legally coerced into using increasingly value-compromised fiat currencies.

As a social technology so fundamental to human cooperation, like spoken language itself, money, to offer the highest utility to the most people, must be governed by rules that cannot be manipulated to benefit one person over another. Somewhat counterintuitively, for money to benefit the most people, governance over its supply must be beyond the reach of everyone. This is why gold ascended to become money on the free market and why it remains the sole instrument for final settlement among central banks today. As the hardest natural money in the world, gold remains the prime monetary sovereignty layer on Earth. From an accounting perspective, where Assets = Equity + Liabilities, gold is purely equity-based, as physically possessing a gold asset is 100% equity and 0% liability; whereas fiat currency is debt-based, as it requires trust in the issuer, its taxing authority, and any payment intermediary associated with its use at any given time.

Simply, gold is the king of natural money; it arose to the role of money as a result of free market processes which, themselves, are operations of nature. Fiat currencies, on the other hand, are artificial; they can only exist in economies where people are coerced into using them via artifices like legal tender laws, capital controls, confiscatory actions, and other anticompetitive restrictions on the market for money. The impetus for fiat currencies existence arises from egoic desires of man like greed, control, and protectionism.

Whereas central banking converts human greed into a race to debase fiat currencies, which inevitably destabilizes economies over time, Bitcoin converts greed into network resiliency and reliability. Bitcoin ingeniously combines the self-interestedness inherent to human nature with electricity and converts them into indisputable records and expansion of its monetary network. The Bitcoin network is itself an embodiment of a free market, where any entrepreneur with access to sufficiently cheap electricity and the necessary hardware can freely enter the market as a miner, that is disrupting the monopolization over the market for money worldwide.

In this sense, Bitcoin is a fractalized free market; its network of miners compete freely to forge an absolutely scarce money that exists outside the scope of monopoly-preserving artifice, thus impressing its free market characteristics onto the world market for money and giving people an alternative to monetary socialism.

Free markets represent a natural organizing principle for humanity that converts the pursuit of individual self-interests into improvement of its collective interests (in Talebian lingo: anti-iatrogenics). This spontaneous order generated by free markets has persisted, to a greater or lesser extent, ever since mankind started trading. Free markets, as an organizing principle, are among the most important in the world as they transmute greed into higher productivity, lower prices, and a stream of new, innovative ideas. What excuse is there, then, to tolerate an unfree market for money? As you’ve said Ray, (p.281) “Remember that most people will pretend to operate in your interest while operating in their own.” This is exactly what the private owners of central banks have been doing for over a century — operating in their own self-interest, under the aegis of government-enforced monopolies, at the expense of everyone else. In this sense, central banking could be the most successful con artistry at scale ever perpetrated.

In nature, energy expenditure is required prior to eating. Plants harvest sunlight into sugar, herbivores spend much of their lives standing and eating plants, and carnivores push themselves to full exertion episodically to hunt. As the 1st Law of Thermodynamics teaches, there is no free lunch in this universe. If there appears to be, you can be sure that hidden risks are accumulating as nature inevitably optimizes for the whole and will eventually restore balance — suddenly and violently if a state of sufficient disequilibrium is reached. Central banks, via the printing press, have spent over a century enjoying a perpetual “free lunch” where control over assets is continuously reallocated from the many to the few; Bitcoin is a (relatively) sudden monetary phenomenon and an economically violent force against banking cartels that is restoring equilibrium to the global economic order.

Bitcoin mining, although often demonized for being tremendously wasteful, may actually have a profoundly positive impact on the world environment. Although this has not been conclusively proven yet, there is research which supports this claim and deductive reasoning suggests it to be true. Consider the following excerpts from a report on this matter:

“Because bitcoin mining is highly mobile compared to overall power demand, it might actually be a boon for global stranded renewables…Whereas traditional industrial and residential power demand is largely geographically captive — be it by proximity to cities, resources, transport links or whatever other factors determine the location of such entities — bitcoin mining can be undertaken pretty much anywhere…This means that some of our most promising sources of renewable energy remain untapped due to their remote locations…Bitcoin mining is a relentless race to the lowest electricity costs and therefore — as explored by Dan Held and Nic Carter — acts as an electricity buyer of last resort…In this manner, bitcoin mining — which offers the possibility of immediate electricity monetization independent of grid connection — can play a vital part in the renewables development cycle.”

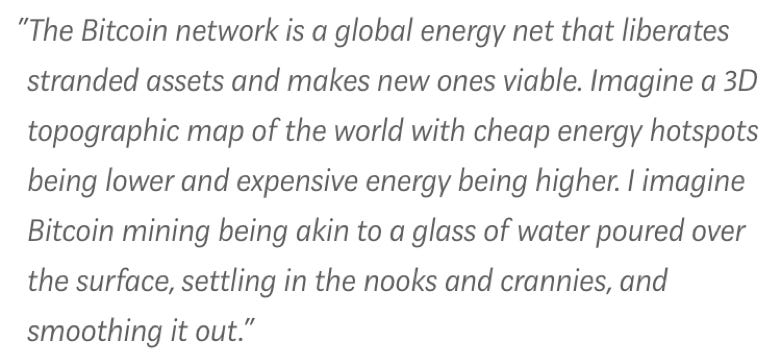

What is an energy buyer of last resort? Nic Carter gives us a useful visualization:

In this sense, Bitcoin mining is as natural as the free market processes of which it is composed. Instead of boiling the oceans, Bitcoin mining may actually help us to clean them up. Ray, as a thalassophile, I am sure this prospect must excite you, maybe you just haven’t looked deeply enough at the nature of this new money to understand its potential environmental impact yet? After all, Bitcoin mining is among the most efficient uses of energy in the world, and increasing mankind’s collective energy efficiency (aka productivity) is the entire purpose of the world economy in the first place:

In a profound sense, as Friar Hass says, Bitcoin is nature; a new form of life — a digital organism. Ralph Merkle, famous cryptographer and inventor of the Merkle tree data structure, has a remarkable way of describing Bitcoin:

“Bitcoin is the first example of a new form of life. It lives and breathes on the internet. It lives because it can pay people to keep it alive. It lives because it performs a useful service that people will pay it to perform. It lives because anyone, anywhere, can run a copy of its code. It lives because all the running copies are constantly talking to each other. It lives because if any one copy is corrupted it is discarded, quickly and without any fuss or muss. It lives because it is radically transparent: anyone can see its code and see exactly what it does.

It can’t be changed. It can’t be argued with. It can’t be tampered with. It can’t be corrupted. It can’t be stopped. It can’t even be interrupted.

If nuclear war destroyed half of our planet, it would continue to live, uncorrupted. It would continue to offer its services. It would continue to pay people to keep it alive.

The only way to shut it down is to kill every server that hosts it. Which is hard, because a lot of servers host it, in a lot of countries, and a lot of people want to use it.

Realistically, the only way to kill it is to make the service it offers so useless and obsolete that no one wants to use it. So obsolete that no one wants to pay for it, no one wants to host it. Then it will have no money to pay anyone. Then it will starve to death.

But as long as there are people who want to use it, it’s very hard to kill, or corrupt, or stop, or interrupt.”

Bitcoin is a technology, like the hammer or the wheel, that survives for the same reason any other technology survives: it provides benefits to those who use it. It can be understood as a spontaneously emergent protocol that serves as a new form of uninflatable money and an unstoppable payments channel. Structurally, the Bitcoin network reflects a quintessential manifestation commonly found in nature — the decentralized network archetype:

The decentralized network archetype found in nature is the antecedent to paradigm shifting innovations throughout history such as the railroad system, the telegraph, the telephone, the power distribution grid, the internet, social media and now Bitcoin.

Although fiat currency is commonly held as the “natural order of things” in modernity (a fallacious form of monetary uniformitarianism), it is precisely the opposite. As you’ve said Ray, (p.280) “to be great, one can’t compromise the uncompromisable.” What excuse was there to compromise the redeemability of dollars for natural money or to so heavily dilute the value of fiat currencies over time? These machinations were solely designed to enhance the expropriative abilities of bankers, bureaucrats, and politicians throughout history; letting them effectively default on their debts and pass on the real costs to citizenries. Far from being a natural form of money, fiat currency became dominant in the world at the end of a long chain of causality — a chain rooted in a flawed system that incentivizes people to operate with smaller time horizons and a zero-sum mentality.

Chains of Cause and Effect

(p.127) “I believe that everything that happens comes about because of cause-effect relationships that repeat and evolve over time.”

Different institutional structures and incentive systems produce different human behaviors. Fiat currency is the most recent, and most extreme, act of money supply manipulation — a practice engaged in by all those who gained the ability to do so throughout history. Interestingly, it was a drawback of monetary metals, the difficulty of assaying their value and authenticity, which gave rise to coinage. The “public stamp” emblazed on the face of coins (usually with a smug emperor’s face) served as the veracity that entrepreneurs of old relied upon, thus converting the need to verify (or assay) money used in each transaction into the need to trust a state-stamped corroboration of monetary value. Almost every time coinage arose, it was not long before rulers engaged in the act of “coin clipping” in which they would periodically gather the coins from the citizenry, melt them down and mint them into newer versions with the same face value but less precious metal content, keeping the residual content to enrich themselves. People, of course, were outraged, as the expression of their preference for hard money was stifled; but this is an unsurprising effect of central planning.

When it comes to economic systems, free markets make customer preferences irrefutable; central planning causes them to become irrelevant.

Similar to modern day inflation, coin clipping was a way of surreptitiously taxing the population by debasing its currency. Nero, the infamous emperor of the Roman Republic, was the first to engage in this deceptive practice. In doing so, he set a malicious precedent that would be emulated by many successive emperors (and later, central bankers) across many different eras and empires. Each time the value-storage integrity of money was compromised by coin clipping or supply inflation, it was only a matter of time before the society which it bound together started to unravel. Centralizing control over a money supply always has, and always will, lead to expanded wealth disparity as those few (rulers, politicians, central bankers) who can extract value from the many (citizens) have always given in to this temptation. Eventually, this parasitism leads to social unrest and, ultimately, revolt.

Interestingly, as the problem of assaying monetary metals shifted the monetary trust function unto the state-backed coinage, this gave demagogues the means to violate the trust placed in their “public stamps” to enrich themselves. Had a monetary technology existed historically that was sufficiently counterfeit and confiscation resistant (like Bitcoin), government may have never grown to become such a significant institution in human affairs. Hard to believe perhaps, but true. Lack of trustworthy money caused the state to flourish; over time, the invention of perfectly credible money may, as a side effect, render the nation-state model anachronistic.

Money is the mechanism through which people market-price and exchange their time; it is the trust fabric through which people weigh opportunity costs and decide where to invest their finite energies and capital. When this cooperative mechanism is manipulated by rulers, the societies which run on the softening money begin to disintegrate as trust in the currency deteriorates, thus inhibiting trade and reversing the division of labor. This causes prices to rise and economic crisis to take hold. Unproperly channeled into a centrally planned economic system instead of a free market, greed becomes inherently self-annihilating.

Greed destroys fiat currencies, but greed secures the Bitcoin network.

Instead of learning these lessons of history, central banks pushed this monetary parasitism to unprecedented extremes. According to you Ray, “From 1950 until 1980, debt, inflation, and growth moved up and down together in steadily larger waves, with each bigger than the one before, especially after the dollar’s link to gold was broken in 1971.” The unitary motion of these economic forces was no coincidence. By breaking the peg to gold in 1971, Nixon set the world on an irreversible course that would be marked by successively larger recessions and (attempted) compensatory rounds of quantitative easing. This death-stroke to the gold standard moved the world into uncharted monetary territory, and became the cause of myriad economic and social problems. Here, we will highlight a few of them (for more on this, check out www.wtfhappenedin1971.com )

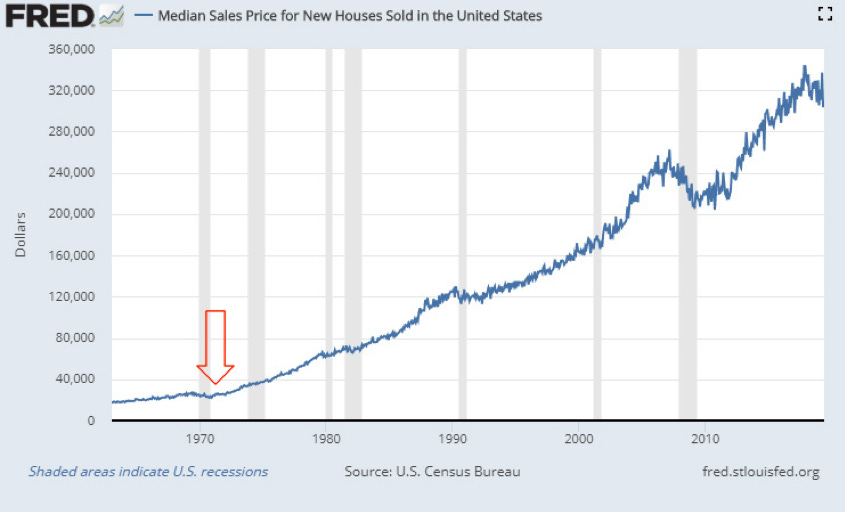

With the store of value functionality of money broken, people began using their homes as savings vehicles, which inflated a housing bubble that bursts in 2008 with disastrous consequences:

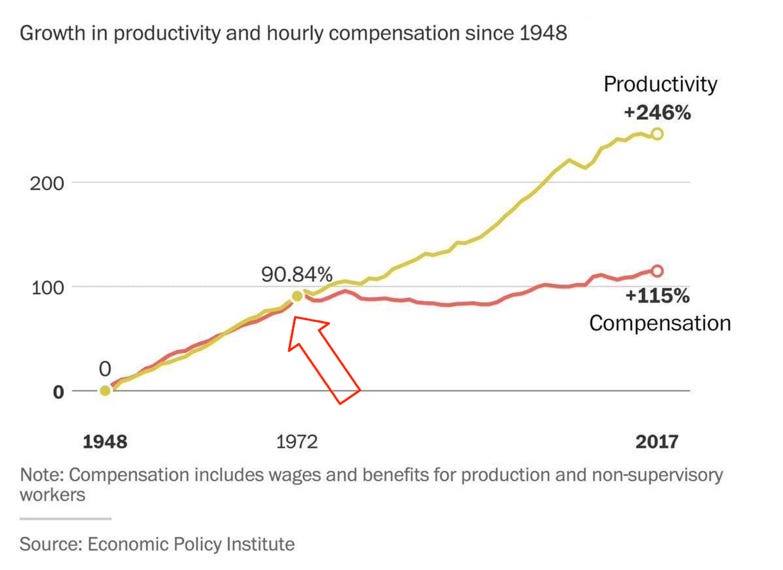

By breaking money’s anchor to reality, control over productive assets was steadily shifted into fewer hands with each economic recession and round of money printing (via the Cantillon effect). This caused an unprecedented decoupling of productivity and wage growth:

This divergence between productivity and compensation meant that more value was being captured by the most wealthy at the expense of the poorest:

Such distortions and wealth redistributions are the inescapable effects of monetary central planning. By manipulating the price of money (the interest rate) central banks spur over-borrowing, capital misallocation, and market distortions. By holding the interest rate below its naturally determined value (at the intersection of the supply and demand curves for loanable funds), central banks interrupt the natural chains of cause and effect which maintain dynamic market equilibria. This, in turn, causes market price movements to become more a function of monetary policy than of actual supply and demand curves. Ray observed this firsthand: “In 1978–80 (as in 1970–1971 and in 1974–75) different markets began to move in unison because they were more influenced by swings in money and credit growth than by changes in their individual supply-demand balances.” This causality still holds and becomes abundantly clear when seen from the right perspective:

These market distortions would not exist in a world with a free market for money. Free markets are ruthlessly efficient and trimming excesses and encouraging optimal allocation of resources; which is why they are so ruthlessly effective at promulgating hard money, because people will naturally select the most liquid asset that best holds its value across time as money first and foremost. Hard money eliminates market distortions because its supply remains rooted in economic reality and beyond the reach of self-interested central planners. Simply, by transitioning to a free market money like Bitcoin, we can eliminate the prime driver of wealth disparity — money supply inflation.

To better understand the root cause of wealth disparity, we use an approach advocated by you Ray: as you’ve said, (p.489) “Root causes are described in adjectives, not verbs, so keep asking ‘why’ to get at them.” Let’s begin our analysis:

Root cause discovery process:

A primary cause of social unrest and societal disintegration is wealth disparity. Alarmingly, this has been on the rise in advanced economies all over the world.

Why is wealth disparity growing?

Disparity in wealth holdings is rooted deep in the monarchical history of mankind. Although some economic inequality is natural, as people are born with unequal skills and predispositions, the (growing) levels seen in modernity are anomalous. Today, few people own most of the productive assets. Under a system of monetary central planning, these few have privileged access to newly printed fiat currency, which represents a redistribution of productive assets to those who receive the newly printed money first at the expense of those who receive it later (via the Cantillon effect).

Why do few people have privileged access to newly printed money?

Those with the most control over productive assets have leveraged their position to monopolize the market for money. These positions are reinforced via the lobbying mechanism, a system of institutionalized bribery, that heavily influences public policy in favor of its financiers’ private interests. Once a monopoly position is firmly established, they employ monetary policy as a means for implicitly taxing entire populations to further enrich themselves (again, via the Cantillon effect).

Why is there a legal monopoly on money?

Again, the few who own the most productive assets within a society are able to (heavily) influence the legal frameworks they operate under. Naturally, these few favor laws which benefit their interests. Primary among these interests is the ability to confiscate wealth via inflation. This privileged position is protected via the government monopoly on violence. Inflation allows early accessors of new liquidity to perpetually extract wealth from all the market participants coerced into using the fiat currency — those who resist face incarceration or violent retaliation.

Why is violence used to insulate the legal monopoly on money?

The root cause of violent coercion such as this is the fearfulness inherent to egoic human behavior. People naturally seek to secure themselves against the uncertainties inherent to the future. To this end money, a tool of pure optionality in the marketplace, is the ultimate hedge against the future. Using the government monopoly on violence, private interests gradually were able to monopolize the market for money, thus obstructing its natural course. Simply, central banks have acquired absolute power, which as we all know, corrupts absolutely. Fiat currency is the ultimate expression of unfree market dynamics.

Per this root cause analysis: the “why” of a growing wealth disparity is causally rooted in the adjective “unfree”. The root cause of a growing wealth disparity, then, is an unfree market for money. Fiat currency is a tool for restricting freedom and confiscating wealth. Bitcoin, like its predecessor gold, is a purely free market money — a tool for maximizing freedom and preserving wealth.

Monetary inflation, a property unique to centrally planned money, is purely a means of wealth confiscation — it does not offer a single equitable benefit to the people. Not one. The virtually limitless power control over the fiat currency printing press affords is the very cause for its existence and monopolization; it is both the means and the ends of monetary socialism. Fiat currency is a governmental tool for taxing, controlling, and manipulating people. As Thomas Jefferson once warned:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

By attempting to centrally plan money, mankind marginalizes his own potential. Although Bitcoin has demonstrated its disregard for the legal restrictions which insulate fiat currencies, it’s impossible to know what monetary technology the market would naturally select absent government interventionism. Monopolization increases costs and stifles innovation, the exact opposite of the effects generated by free markets. Devolution is the inevitable and disastrous effect of monopolization, whereas free markets cause the reverse — evolution.

In Part 5, we will continue our exploration of Ray’s principles and their relationship to Bitcoin/money, beginning with evolution.