Three Things I’ve Learned Being in Bitcoin

The Bitcoin Rabbit-Hole is bottomless, and it changes one's views on many things...

Introduction

During my years tunneling down this rabbit-hole, I’ve come to realize that since nobody can change Bitcoin, everybody will eventually be changed by Bitcoin. For me, Bitcoin continues to be a seemingly inexhaustible source of learning: it has (directly or indirectly) transformed my eating habits, my intellectual fascinations, and my personal values. Here, I will share some things I’ve learned while being in Bitcoin.

There Are Only Two Ways to Acquire Wealth

Intent on creating better living conditions, individuals organize themselves into groups to become more productive. Through collaboration, humans can increase their productive output (goods) per unit of input (labor). Increasing productivity in this way is equivalent to becoming more wealthy and prosperous. Age-old adages such as “two heads are better than one” and “many hands make light work” speak to this core economic purpose of human collaboration. Indeed, when we analyze the word collaboration we find co- and labor meaning “to labor together.” Like Marcus Aurelius said, human beings are purpose-built for collaboration:

“We were born to work together like feet, hands and eyes, like the two rows of teeth, upper and lower. To obstruct each other is unnatural.”—Marcus Aurelius

Collaborating is the most effective way in which humans can create wealth. Or, said differently, working together is the most effective way humans can free time. The more intensively humans coordinate their actions, the more liberated their time becomes from the drudgeries of basic subsistence. Economists call this wealth-generative dynamic the social division of labor. In this way, coordination of human action allows us to liberate ourselves from economic scarcity.

By focusing on increasing productivity, humans can accomplish ever-greater results with the same levels of effort. This somewhat simple physical reality of productivity growth under a social division of labor is the reason humans self-organize into groups in the first place. If it were untrue that humans acting in concert produce more than humans acting is isolation, then it is likely we would all lead more solitary lifestyles.

Given that human beings are able to accomplish greater results by coordinating their actions, I assert that the entire purpose of human self-organization is wealth acquisition. Wealth is equivalent to free time—the “economic fruit” cultivated through collaboration. In this way, all human organizations are businesses, in the sense that they involve exchange and must generate wealth to continue to exist. This includes groups or organizations which you may not traditionally think are businesses, such as your household, church, or government. If there is no net wealth creation to be gained by individuals through their organizational efforts, then the business will surely fail.

If all human organizations are businesses, and the purpose of business is to generate wealth, then all human organizations are effectively wealth acquisition strategies. This framing is useful for evaluating the moral status of business enterprises. In this universe, there are only two possible ways to acquire wealth: one is by Making and the other is by Taking (I will capitalize Making and Taking throughout this written work in specific reference to these ways of acquiring wealth). Making and Taking are mutually exclusive wealth acquisition strategies: an individual can only actualize one or the other in any given action. Making is the way of the worker or the entrepreneur engaged in production and exchange: what the great sociologist Franz Oppenheimer referred to as “the economic means” of acquiring wealth. Taking is the way of the thief or statesman, a simpler yet sadistic path that subtracts from productivity since it involves spending time engaged in the act of stealing other people’s stuff by force, or threat thereof. Standing in contradistinction to the productive activities encompassed by Making, Taking is the unilateral theft or confiscation of another’s assets. In other words, Taking is the seizing of wealth, which are the products of human time. Since building something is usually more difficult than seizing that same something, Taking is often a viable wealth acquisition strategy. However, since Taking is nonproductive, it is inherently destructive to aggregate wealth creation. Oppenheimer referred to Taking as “the political means” of acquiring wealth. As Rothbard writes in The Anatomy of The State:

“It should be clear that the peaceful use of reason and energy in production is the “natural” path for man: the means for his survival and prosperity on this earth. It should be equally clear that the coercive, exploitative means is contrary to natural law; it is parasitic, for instead of adding to production, it subtracts from it. The “political means” siphons production off to a parasitic and destructive individual or group; and this siphoning not only subtracts from the number producing, but also lowers the producer’s incentive to produce beyond his own subsistence. In the long run, the robber destroys his own subsistence by dwindling or eliminating the source of his own supply.”

The greater the proportion of business activity engaged in Making relative to that engaged in Taking is the same degree to which human civilization will flourish. Businesses engaged in Making increase total wealth creation by increasing human productivity. Businesses engaged Taking decrease total wealth creation by decreasing human productivity. Making is the way of entrepreneurship: it is a positive-sum game, meaning that win-win situations are possible. In other words, Making is what expands the proverbial “economic pie.” Taking is the reverse: it is a zero-sum game, meaning that one person’s gain is necessarily another person’s loss. Slicing the “economic pie” into more pieces and divvying them up in a different way does not mean there is more “pie” to go around.

Making and Taking are the only wealth acquisition strategies available: there are no alternatives. So the big question is: how can humans create conditions in which Making is more prevalent than Taking? In short, how can we maximize our Making-to-Taking ratio, which is another way of asking how do we maximize productivity and thus optimize the economic conditions necessary for human flourishing? To answer this question we need to understand the nature of private property which, as we will see, can be described as one of the most important relationships individuals can have with nature. This brings me to another important thing I learned while traveling down the Bitcoin rabbit-hole…

Private Property is the Private Ownership of Wealth

Your car is not property. Real estate is not property. Nothing that you own is property. Property is not any asset whatsoever. Rather, property is the exclusive relationship between a person and an asset. The person designated with the authority to fully control an asset, and exclude others from its use, is its rightful owner. Property then, properly understood, is the binding between rightful owners and their assets. In this more precise sense, and using more modern parlance, private property may be more aptly called private ownership.

Most fundamentally, each of us is naturally vested with the power to fully control our own body and exclude others from its use. As such, each individual’s natural binding to their own body is their most fundamental form of private ownership. Put simply, if you have a body, then you have private property. You, as your body’s sole owner, enjoy the exclusive rights to use any of its “features” on-demand. However, as its owner, assuming you wish to continue enjoying your body’s many “features,” you are also responsible for its maintenance and fixing all of its “bugs.” In this way, “property rights” may equally be called “property responsibilities.” What is true of one’s own relationship with one’s own body is also true for the assets one justly acquires in the world. If you worked to make it, or traded the goods created through your work for the goods someone else justly acquired, then you own those goods justly. For these reasons, rights are responsibilities are two sides of the same coin within the social institution of private ownership.

By each of us using our body’s “features” and taking care of its “bugs,” we can extend our individual self-ownership into the material world through work. By combining one’s labor with the manifold substances naturally occurring in the world, one can create new and useful assets. The assets that are created through productive work make our world an even more “feature rich” environment. Not only does universalized private ownership maximize the rate of asset creation in the world, but it also increases the carrying capacity of civilization in terms of supporting a larger human population. However, as is true with your own body, to continue enjoying the “features” of the assets thus created places the responsibility of fixing their “bugs” squarely with each asset’s individual owner. If owners wish to continue enjoying their assets—including their own bodies and other goods—they must uphold their responsibilities for maintaining and protecting them. In this way, universalized private ownership is the ideal condition to optimize human rights, human responsibility, and, thus, human flourishing—both individually and collectively.

Further, as Rothbard points out in The Ethics of Liberty, there is no ethical alternative to universalized private ownership, which implies universalized self-ownership, as all other forms of individual ownership degenerate into the schism of a ruling and a ruled class:

“For it is physically impossible for everyone to keep continual tabs on everyone else, and thereby to exercise his equal share of partial ownership over every other man. In practice, then, this concept of universal and equal other-ownership is Utopian and impossible, and supervision and therefore ownership of others necessarily becomes a specialized activity of a ruling class. Hence, no society which does not have full self-ownership for everyone can enjoy a universal ethic. For this reason alone, 100 percent self-ownership for every man is the only viable political ethic for mankind… Can we picture a world in which no man is free to take any action whatsoever without prior approval by everyone else in society? Clearly no man would be able to do anything, and the human race would quickly perish. But if a world of zero or near-zero self-ownership spells death for the human race, then any steps in that direction also contravene the law of what is best for man and his life on earth.”

So, seeing that private ownership both maximizes aggregate wealth creation and is the only ethical option for constructing any socioeconomic system, the big question now becomes: how can humans universalize the ethic of private ownership across all of our interactions? The somewhat strange answer is that you must convince individuals to act as if this ethic is so for it to be so. This brings me to the next thing I’ve learned being in Bitcoin…

Private Ownership is a Dramatic Enactment

By blending one’s labor with natural resources, one can make a fishing net, build a business, or engage in any number of other productivity-enhancing activities. These “fruits of labor” become bound to us as our property. Of course, an unbreakable binding between individuals and assets is only possible to the extent that it is enacted. Similar to other social constructs such as money or the calendar, private ownership exists precisely to the extent that we all act as if it exists. For instance, for us to successfully coordinate a meeting at 4p CT on Monday February 20th, 2023, we must each act as if the arbitrarily assigned calendar system is real. In other words, we must abide by the consensus of the social construction known as Gregorian calendar system. In this sense, private ownership is more like an implicit social agreement than an intrinsic law of nature. Unlike the laws of physics, which hold regardless of human action or opinion, private ownership must be enacted continuously to remain in existence. In other words, private ownership is a normative structure: a ritualized enactment of what is just or what “ought to be” through a general consensus on recurrent patterns of action, expectations of etiquette, and social roleplaying. For private property to be an effective normative structure, individuals must dramatize it into existence.

Looked at in a slightly different way, private ownership is something which people LARP into existence. That’s right—LARP’ing (or, Live Action Role Playing)—is what you’re doing when you open a bank account, buy apples at the grocery store, or engage in any consensual exchange of titles to private property whatsoever. In physical reality, nobody actually has an exclusive right to any asset whatsoever (with the exception of bodily autonomy, which cannot be alienated by any individual, even consensually). It is only in the imaginal space of reciprocal play where the relationship of private ownership can be made real through an ongoing dramatic enactment.

Somewhat paradoxically, when everyone “plays” by the rules of private ownership, this act of “playing” becomes the only “working” way of maximizing total wealth creation. By universalizing respect for individual property relationships, the pretend play of private ownership promulgates perhaps the most pragmatic economic outcome imaginable: the unparalleled expansion of human populations, types of innovations, and rates of wealth creation. In this way, private property is the serious game of pretend which constitutes a core pillar of civilization itself. The rules of the game are simple: everyone owns what they Make, and doesn’t own what they Take. In other words, civilization in a pure sense is the ideal dramatization of the principle of justice: a realm in which everyone gets what they deserve from an economic standpoint. As Mises put it succinctly:

“If history could teach us anything, it would be that private property is inextricably linked with civilization.”

Of course, there is always an incentive to break out of the LARPing of private ownership, and to simply seize someone else’s assets by force. As discussed above, this act of Taking is often the path of least resistance, since it is most often more difficult to build than it is to steal. For instance, in most cases it takes much less effort to seize a house rather than to build a house. By “defecting from the game” of private property, a defector chooses to disregard the rules of civilization by resorting to the uncivil act coercion—equivalent to the Taking strategy of wealth acquisition discussed earlier. As a common path of least resistance, it is often financially profitable for Takers to set aside any scruples they may have, and to just steal the assets they want from Makers. This is why Makers require cost-effective means for defending their private property from Takers.

In the final analysis, ownership grounds out in an owner’s capacity to maintain and protect his assets. Given the ever-present risk of someone choosing to defect from the reciprocated game of respecting private ownership, the best we can do in a purely economic sense is to focus on structuring incentive systems in which Taking is made as financially unprofitable as possible. To this end, the rule of law is useful as a disincentive to Taking, but making property cheaper to defend is better, as it reduces nonproductive expenditures on legal protection and enforcement. As the cost of preserving private ownership declines, so too does the expected value calculation (a proxy for financial profitability) of aggressing against private property. Considered in combination with the penalties that are imposable for breaking the law, aggression against private property can even be made financially unprofitable. Given that humans are inclined to engage in any action that is financially profitable, creating socioeconomic systems in which coercion is less lucrative is a surefire way to mitigate the employment of Taking as a wealth acquisition strategy in the world. In other words, to the extent that Taking is made financially unprofitable, profit-seeking humans are persuaded to engage in Making rather than Taking as their preferred wealth acquisition strategy.

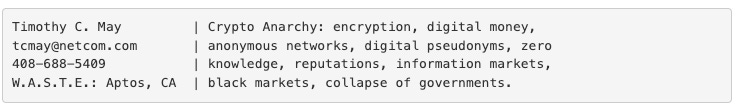

When held in a proper custody model, the private ownership of Bitcoin is the most expensive property relationship to break in human history. As more individuals hold their savings in (properly secured) Bitcoin, business models employing Taking as a wealth acquisition strategy (such as statism) become less profitable, and therefore less widespread. In other words, choosing to hold one’s liquid wealth in Bitcoin is a vote cast against the prevalence of Taking. In this way, saving in Bitcoin marginalizes the business of statism and all its many negative externalities such as coercion, compulsion, and warfare. The seemingly simple change of creating conditions under which Taking is more expensive triggers a cascade of socioeconomic reconfigurations that many Bitcoiners believe will culminate in the collapse of The State as the dominant institution of modernity. As the prescient crypto anarchist Timothy May summed up this probable sequence of events in his email signature from way back in 1988:

Bitcoin has taught me a great deal, and it seems I still have much to learn from this radical new innovation. Bitcoin is a unique technology in many ways: it is the world’s only decentralized organization, its only inviolable form of private ownership, and its only incorruptible monetary network. Bitcoin tilts the economic incentive landscape toward a maximization of the Making-to-Taking ratio in business enterprises across the world, for the rest of time. It accomplishes this by making private ownership much more cost-effective to defend. The net result of Bitcoin’s successful monetization promises to be a massive shift to the ways in which human beings act toward one another. At the level of individual character development, each of us are strongly influenced by the incentive structures we inhabit, and Bitcoin financially incentivizes the enactment of liberty and justice for all, by all. For these reasons, Bitcoin is radically changing the world by being unchangeable, and I am extremely grateful to be a student of this fascinating new socioeconomic paradigm.

Thank you for reading Three Things I’ve Learned Being in Bitcoin

PODCAST

SOCIAL

SUPPORT

Send Bitcoin to my PayNymID: +tightking693

If you’ve found my work to be valuable, please join our private telegram group:

My sponsors are all mission-driven organizations focused on themes explored on my podcast such as freedom, education, self-sovereignty, etc. Please check them out, and where applicable use discount code BREEDLOVE unless otherwise instructed.

Muchas gracias para compartir tus ideas. Aquí la traducción en Español https://veintiuno.world/articulo/tres-cosas-que-he-aprendido-estando-en-bitcoin/

It's great to see you writing again! Thank you for this very informative and shareable post.