Discover more from The Freedom Analects

Sovereignism Part 6: Strategy of Statism

A 12-part essay series exploring the disruption of the nation-state and the subsequent amplification of individual sovereignty during the Digital Age.

This series is loosely based on the 1997 masterwork: The Sovereign Individual.

“Exodus believes in empowering the individual to control their wealth and financial destiny and has provided financial support for the research and writing of this series. Exodus has no editorial control over the content of these writings.”

Sovereignism Part 5 made the case that the modern obsession with politics, including its injection into individual and group identity, is a mass-psychosis premised on the violability of property. This delusion is aggravated by the corruption of money—humanity’s most important (psycho)technology—which not only distorts the denominator of economic exchange, but is also used to violate the property rights of citizens worldwide through unbridled inflation of fiat currency supplies. As incorruptible money and inviolable property, Bitcoin is an elixir to the mass-psychosis of politics.

Here in Sovereignism Part 6, we will lay out the general business strategy of statism and walk through the collapse of Soviet communism in the late 20th century, an episode useful in understanding the upcoming failure of statism more broadly defined. This will set up a return to the relationship between mass-psychoses and the monopolization of money explored in Part 7. First, let’s take a look into the business strategy of the biggest enterprise in the modern world—statism.

The Business of Statism

“The state used the resources extracted from a largely disarmed population to crush small-scale predators. The nation-state became history’s most successful instrument for seizing resources. Its success was based upon its superior ability to extract the wealth of its citizens.”—The Sovereign Individual

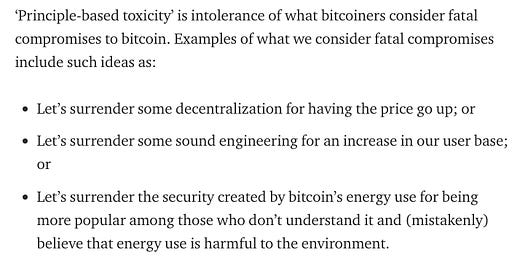

Statism is a condition in which government—the apparatus of coercion, compulsion, and violence—holds substantial sway over economic activity. Like any other business, statism is driven by economic considerations like revenue and profit: all politics of statism are downstream of its economics. According to economic law, there are only two ways to acquire wealth: by making and by taking. Sovereignism is based solely on making, whereas statism (including its “brands” of communism, fascism, capitalism, etc.) is based strictly on taking. In fewer words: free markets make; states take.

Making and taking is a not a novel dichotomy of wealth accumulation strategies. Oppenheimer called the free market method of wealth creation “the economic means” and compared it to the coercive means of acquiring wealth, predominantly wielded by statists, which he called “the political means.” Straightforwardly, Oppenheimer defined the state as: the systematic organization of the political means. This is why Clausewitz was right to call war an extension of politics: each involves imposing the will power of some people onto others. When the political means becomes more prevalent than the economic means—when taking outweighs making—the economic pie shrinks and armed conflict over the remaining slices tends to ensue. As the 20th century taught us, statism taken to the extreme is a potentially cataclysmic enterprise.

Every organism, organization, and institution has this in common: each is a strategy for acquiring more territory (expressed by humans as wealth or property) for purposes of reproducing itself. This “territorial imperative” is a basic biological impulse inherent to most social species—it is the reason birds build nests, wolves hunt in packs, and humans strive to acquire assets. Wealth can only be generated through delayed consumption and investment, an economic reality that is maximized by strong property rights. But as more wealth is created, the incentive to violate property rights and forcibly acquire the wealth of others increases in tandem. The key takeaway: all organisms, organizations, and institutions are businesses—their common Darwinian aim is the acquisition and control of more of wealth, by hook or by crook (or as Michael Goldstein bluntly states, “Everyone’s a Scammer”).

Statism is a wealth acquisition strategy involving coercion, compulsion, and violence. Nation-states, like any other business, share a common aim—growth and profit maximization. Leveraging their natural monopolies on violence, states virtually always centralize control over at least the market for money (as is still the case in the US-brand of state-marginalized “capitalism”), or at most they take control over the entire economy (as was the case in 20th century communism). No matter what form a modern state takes, it depends on standardizations to increase its bottom line.

Enforced Standards for Scaling Taxation

“The conquerors of our days, peoples or princes, want their empire to possess a unified surface over which the superb eye of power can wander without encountering any inequality which hurts or limits its view. The same code of law, the same measures, the same rules, and if we could gradually get there, the same language: that is what is proclaimed as the perfection of the social organization… The great slogan of the day is uniformity.”—Benjamin Constant, De l’esprit de conquête

Core to the business strategy of statism is standardization. By arranging and measuring populations in precise ways, under common standards, states can simplify the classic functions of taxation, conscription, and suppression of rebellion. In other words, a primary aim of statism is to improve the “legibility” of citizenries, for purposes of streamlining the flows of tax revenues. Since the main revenue sources of states involve the application of coercion, compulsion, or violence—we will categorize all of these (non-consensual) revenue types collectively as taxes. All taxes are violations of individual self-ownership and the property rights derived therefrom. Therefore, when options to avoid incurring tax liabilities are available, citizens take them. States, in turn, strive to make taxation as invisible and unavoidable as possible. Common standards are key to the economically efficient generation and collection of taxes.

Premodern states were inefficient in their exactions on citizens precisely because they lacked fast and accurate information systems. These early states knew little about the net worths, the total land holdings, crop yields, or even identities of their citizens. Without common standards to calculate and communicate, the business of statism was largely localized and lacked a synoptic view of its subjects. In comparison with modern nation-states, premodern states were low-tech operations. Fixed costs weighed down early monopolists of violence and inhibited the efficient scaling of statism. Adopting lessons from private forestry operators and other enterprises centered on manipulation of the natural world, eventually statesmen learned they could obtain greater operating leverage through the imposition of certain protocols.

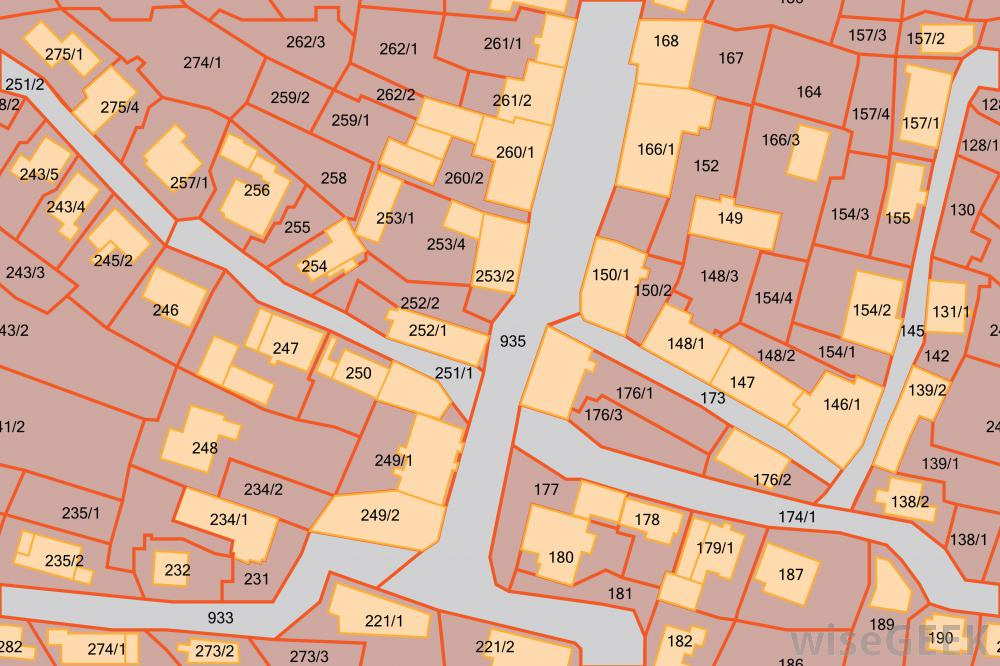

Rather suddenly in the grand arc of history, states began to establish a gamut of standardization practices including permanent last names, uniform weights and measures, cadastral surveys, consistency of legal discourse, urban design, and the control over the transportation of goods. All of these efforts made the taxable activities of citizens more easily measurable. An old saying rings true here—“what get’s measured, gets done”: through improved legibility, the coercive actions of statecraft could be executed with greater precision. Equipped with a higher resolution understanding of the commercial activities of citizens, statesmen could now scale their own businesses by lowering the fixed costs of tax assessment and collection.

Clearer maps of the territories under state dominion was a powerful instrument, useful in the redrawing of those very maps in ever-higher resolutions. This retooling of statist information systems came at a time when humans were successfully imposing organizational standards on other aspects of nature. Agriculture and forestry are two obvious examples in which humans systemize and standardize appropriations from nature in ways suitable to their needs. Scientific forestry, plantation layouts and collective farms were all administrative specialization businesses intended to improve the yield of their respective crops.

Assets and terrains mapped in higher resolution exhibited greater legibility for the eyes of overseers, therefore affording greater operating leverage to statesmen. In short, legibility is directly proportional to asset manipulability. Central and top-down control became much more effective in state information systems with much lower transaction costs. In the great tome Seeing Like a State, author James C. Scott gives us an excellent analogy connecting this tendency of humans to impose control over the fruits of nature and one another:

“A homely analogy from beekeeping may be helpful here. In premodern times the gathering of honey was a difficult affair. Even if bees were housed in straw hives, harvesting the honey usually meant driving off the bees and often destroying the colony. The arrangement of brood chambers and honey cells followed complex patterns that varied from hive to hive—patterns that did not allow for neat extractions. The modern beehive, in contrast, is designed to solve the beekeeper’s problem. With a device called a “queen excluder,” it separates the brood chambers below from the honey supplies above, preventing the queen from laying eggs above a certain level. Furthermore, the wax cells are arranged neatly in vertical frames, nine or ten to a box, which enable the easy extraction of honey, wax, and propolis. Extraction is made possible by observing “bee space”—the precise distance between the frames that the bees will leave open as passages rather than bridging the frames by building intervening honeycomb. From the beekeeper’s point of view, the modern hive is an orderly, “legible” hive allowing the beekeeper to inspect the condition of the colony and the queen, judge its honest production (by weight), enlarge or contract the size of the hive by standard units, move it to a new location, and, above all, extract just enough honey (in temperate climates) to ensure that the colony will overwinter successfully.”

Operating efficiency is clearly a vital aspect of every business, including states, where revenues consist entirely from coercive exactions on citizens. Again, taxes are a form of taking. Combined with the fact that politicians have no long-term interest in the tax base, the incentive schema inhabited by statesmen (and stateswomen) today, who are in charge of the world’s most powerful martial force—the nation-state—influences them toward a set of actions which are high time preference, extractive, and unconcerned with the long-term wellbeing of their underlying economic networks.

Despite the hollow rhetoric (a malicious wielding of a potent psychotechnology intended to cover up the true nature of statism), bureaucrats and politicians have little to no incentive to actually take action toward any aim other than increasing state revenues through deal-making that improves their own financial positions. For instance, a modern nation-state policymaker commonly cycles through the proverbial “revolving door” between regulation and industry. First, acting in the capacity of a law-maker, an official will craft nuanced regulations, then when their term expires they will go to work as consultants in the respective industries they had previously been responsible for regulating. This means they are perfectly positioned and to exploit (and even preemptively create) loopholes in the regulations they pen.

Such perverted incentives are only exacerbated through the virtually limitless theft fiat currency enables. The net outcome is more corruption, a larger state, a steady nationalization of major industries, more taxes, more inflation, and less freedoms for citizens. Remember: a citizen taxed at 100% is a slave. The incentives associated with statism force citizens further along the continuum from a 0% taxed sovereignist toward a 100% taxed slave. To this end, standardization of taxpayer (or, potential slave) data is of the utmost importance to the operational efficiency of statism as a business.

Unsurprisingly, since the original purpose of the state was to preserve private property rights to protect productive trade networks, those models of statism which most closely fulfilled this free market function tended accumulate more wealth. As we will see, statist capitalism outcompeted communism for related reasons, an economic sequence which in the author’s estimation presages a collapse of all statist business models in the years ahead. Through this lens, the fall of the Berlin Wall was symbolic of a much more significant socioeconomic shift than is commonly understood…

The Symbolic Fall of the Berlin Wall

Originally intended to preserve property rights from endogenous and exogenous threats, states historically directed their efforts toward protection-production and territorial expansion. However, following the economic abundance unlocked by the global industrialization going into the 20th century, these monopolists on violence increasingly turned their efforts toward increasing exactions from their citizens. Pivoting from preservation to the violation of private property is the dark path taken by states historically: a change in tendency which typically leads to social upheaval and revolution. Walls, militaries and institutions formerly intended to defend the economic interests of citizens invariably become the means of imprisoning them in tax farms. In the 20th century, the fall of the Berlin Wall was historically significant in that it represented the rupturing of the communistic state tax farming strategy.

“The Berlin Wall was built to a very difference purpose than the walls of San Giovanni—to prevent people on the inside from escaping rather than to prevent predators on the outside from entering.”—The Sovereign Individual

Following the collapse of the Berlin Wall, US President Bill Clinton proposed a “Berlin Wall for Capital”: an exit tax that would require Americans above a certain threshold of net worth to forfeit a substantial sum to escape the predatory, globalized tax system of the US. Unlike many other countries, the American tax system was based on global income and assets, instead of being localized within the state doing the taxing. This draconian ransom is reminiscent of the measures taken by the declining Roman Empire when its fiscal position was undergoing a rapid deterioration. This well-written passage from The Cambridge Ancient History details the confiscatory actions of the collapsing Roman Empire:

“Thus began the fierce endeavor of the state to squeeze the population to the last drop. Since economic resources fell short of what was needed, the strong fought to secure the chief share for themselves with violence and unscrupulousness well in keeping with the origin of those in power and with a soldiery accustomed to plunder. The full rigor of the law was let loose on the population. Soldiers acted as bailiffs or wandered as secret police through the land. Those who suffered most were, of course, the propertied class. It was relatively easy to lay hands on their property, and in an emergency, they were the class from whom something could be extorted most frequently and quickly.”

Western welfare and warfare states—chief among them the United States—depend on their ability to continue extracting a significant portion of economic output via taxation for their stability and, ultimately, viability as profitable business models. To satisfy current budgetary demands—which are overloaded with many decades of accumulated entitlement spending, bureaucratic inefficiencies and other wasteful misallocations of capital—Western states today must price their services at “supermonopoly” rates. In the digital age of hyper mobile populations, information, and capital, the supermonopoly markup of government services by 10,000% or more of their production costs will no longer be tolerated by citizens empowered with such radical new degrees of optionality. As covered in previous installments of this sovereignism series, the tighter politicians squeeze, the faster Bitcoin succeeds. This is not a theory, this geopolitical game is already underway:

Indeed, it is precisely this economic squeeze that will cause sovereignists to “set sail” into digital space and to physically move to jurisdictions where they are treated most favorably. The nation-states resistant to this economic reality are effectively “fighting the tide” of individual self-interest—a demonstrably futile endeavor when viewed through the longest arc of history. This mega-political transition has been many decades in the making, and the fall of the Berlin Wall was an early watershed moment, symbolic to the coming failure of statism:

“The fall of the Berlin Wall was more than just a visible symbol of the death of Communism. It was a defeat for the entire world system of nation-states and a triumph of efficiency and markets. The fulcrum of power underlying history had shifted. We believe that the fall of the Berlin Wall in 1989 culminates the era of the nation-state, a peculiar 200 year phase that began with the French Revolution. States have existed for 6,000 years. But before the 19th century, they accounted for only a small fraction of the world’s sovereignties. Their ascendancy began and ended in revolution. The great events of 1789 launched Europe on a course toward truly national governments. The great events of 1989 marked the death of communism and an assertion of control by market forces over massed power.”—The Sovereign Individual

Market forces overcoming the arbitrary barriers on information and capital was physically manifest in the fall of the Berlin Wall. Symbolically, this event portends the coming surrender of statism to the principle of inviolable property enshrined by the emergence of Bitcoin.

Statism Surrenders

Market forces formerly suppressible have begun to burst through the dams of artifice erected by modern nation-states. Statist impediments include capital controls, legal tender laws, and hostile tax policies: all implemented to interrupt the flows of voluntary human action. The rise of the nation-state was a mega-politically induced event; it was not due to the fulfilled wishes of statesmen or political theorists. In thematic accordance with sovereignism, it was the hidden logic of violence which moved history into the era of larger and more top-heavy state power structures. States of the past angled for centralized control over critical resources—like water—to enforce adherence to their monopolies on violence and systems of tax collection. However, lack of resource concentration typically made premodern statism unsustainable.

“Prior to the modern period, most states were ‘Oriental despotisms,’ agricultural societies in deserts dependent upon control of irrigation systems for their survival. Even the Roman Empire, through its control of Egypt and North Africa, was indirectly a hydraulic society. But not enough of one to survive. Rome, like most premodern states, ultimately lacked the capacity to compel adherence to the monopoly of violence that the ability to starve people provides. The Roman state outside of Africa could not cut off water for growing crops by denying unsubmissive people access to the irrigation system. Such hydraulic systems supplied more leverage to violence than any other mega-political configuration in the ancient economy. Whoever controlled the water in these societies could extract spoils at a level almost comparable to the percentage of total output absorbed by modern nation-states.”—The Sovereign Individual

Monopolizing water was a prohibitively expensive strategy is most situations given its wide geographic distribution. Modern nation-states circumvented this physical-space-induced shortcoming by instead monopolizing humanity’s economic water—money. Modeled after measure #5 in the 1848 Manifesto to the Communist Party which reads: “Centralization of credit in the hands of the state, by means of a national bank with State capital and an exclusive monopoly,” central banking gives the nation-state the apparatus of surreptitious wealth extraction necessary to grow into its presently bloated level of bureaucracy and inefficiency. In other words, fiat currency is used to pay for all the “red tape” which binds modern citizens.

Central banks siphon away large portions of the wealth generated by their underlying, and largely unaware, productive market actors through excessive regulation and taxation. Hence the reason Marx loved central banks. Most importantly for nation-states, the central bank offered access to the most unlimited war-chest ever devised—the spigot of fiat currency, which could be printed to confiscate the savings of citizens up to the point of the “crack up boom.” Unlike ancient monarchies, who were forced to wage war within the confines of their own balance sheets, modern nation-states are comparatively unrestrained monetarily. Shadow taxation via inflation has historically been especially important for funding state violence:

“Most important of all, success in war depends on having enough money to provide whatever the enterprise needs.”—Robert De Balsac, 1502

Central banking and fiat currency dramatically magnified the scale and consequences of armed conflict in the 20th century. Similar to all-out territorial combat between two apex predators, all that mattered in the determination of which country would be the next world superpower was a nation-state’s total capacity to marshal wealth and expend it to project force across spacetime. Unlike honest, competitive businesses adhering to the principle of inviolable property—a tenet at least as ancient as the 13th century Magna Carta—state dominion was historically more dependent on the magnitude force it could bring to bear rather than its efficiency. Said simply: violable property amplifies state-sponsored violence. As historian Charles Tilly wrote:

“States having the largest coercive means tended to win wars; efficiency (the ratio of output to input) came second to effectiveness (total output).

Per this clearly well-defined economic ratio, the nation-state model which was able to maximize the consistent generation and taxation of wealth was bound to emerge victorious in the struggle to become the superpower within the geopolitical hierarchy. Economic reality, not patriotism or ideology, determined the outcome of the 20th century contention between the statist brands of capitalism and communism.

Although conventional wisdom conceives of communism as antithetical to capitalism, when states are involved, they are in truth more alike than different: each is a statist business strategy intended to facilitate the materialization and control of wealth by a central government. The core difference between the two is that capitalism was more generative of wealth, since it depended on free (albeit marginalized) markets rather than outright communistic control. In other words, state-capitalism benefitted from its greater emphasis on “bottom-up” economics when contrasted with the absolute “top-down” approach of communism. As a result, capitalist states became vastly more wealthy than communist states, giving them the resources necessary to outcompete.

Seen through the lens of statism, it is clear that state-sponsored capitalism and communism have more in common than is traditionally believed. The fall of the Berlin Wall symbolized much more than the death of communism; this historic event was the geopolitical tremor presaging the coming collapse of the nation-state model of human organization.

Viewed as a competing business model, Soviet Russia’s sudden demise was simply the collapse of an inferior statist strategy. Think of the violability of property as a dial which the state could “turn up” when it needed to increase its revenue. The catch of course, is that by turning up this dial, the assurances market actors need to generate wealth are dissipated, causing a breakdown in the division of labor and its attendant wealth creation. The optimal strategy for statism, then, was to turn up the “property violator dial” gradually—specifically, at a rate slower than competing states—such that the marketplace could continue to generate wealth for further “harvesting” via taxation.

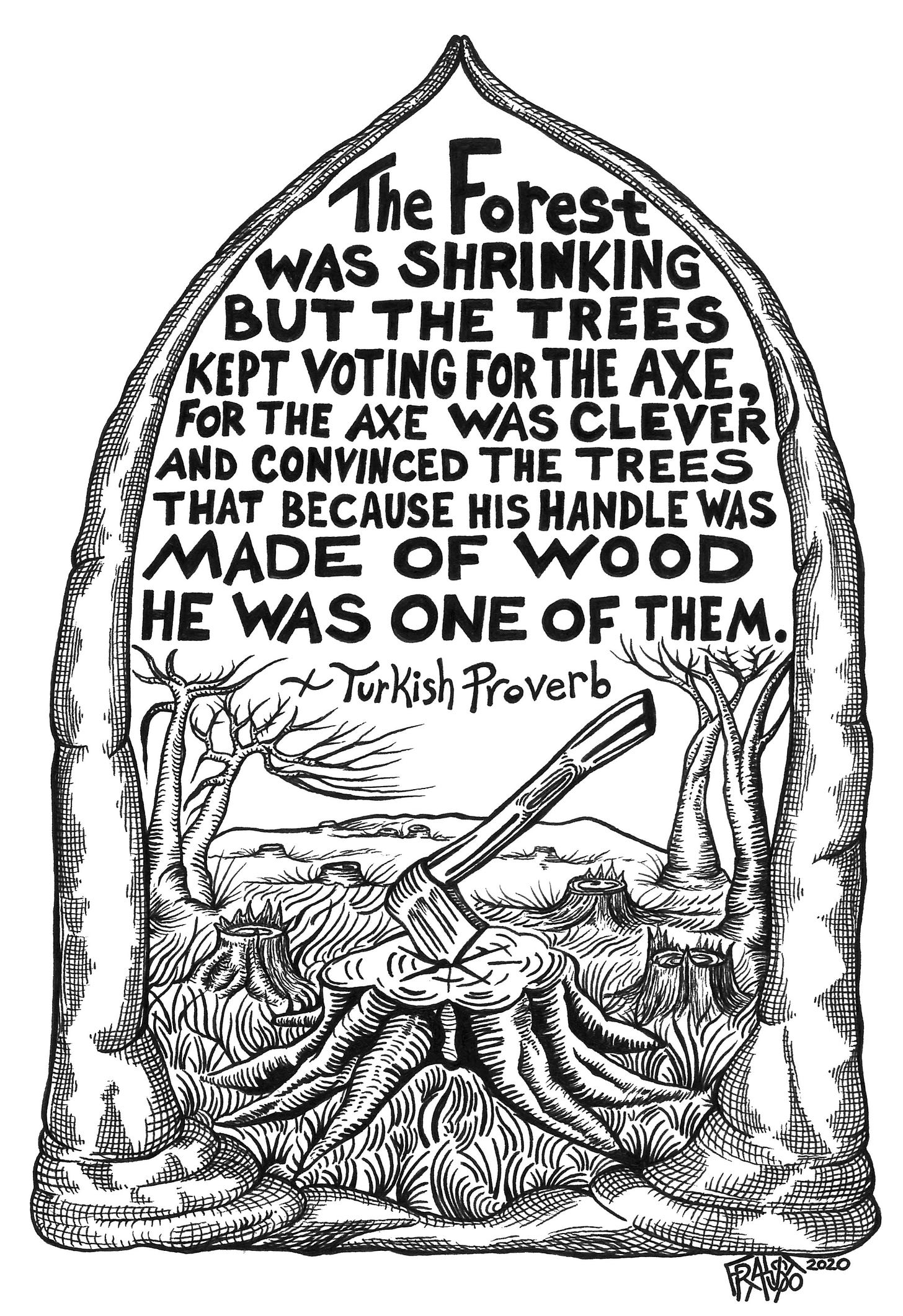

State-capitalism practiced in the US was simply less aggressive in its violations of property than the competing strategy of Soviet communism. Initially offering a greater alignment of incentives between market actors and state confiscators, US-capitalism proved itself as a more profitable business model in this 20th century statist contention. Revisiting our earlier forestry analogy, capitalism allowed the forest (the free market) more time to mature before harvesting its lumber (the wealth of citizens). Democracy, the governance mechanism overlaying US-capitalism, then became nothing more than a “property violator dial” for gaining control over the potential proceeds which could be later stolen through taxation.

“The democractic welfare state, by contrast, made more modest claims, and thereby employed superior incentives to mobilize greater output. Instead of laying claim to everything in the beginning, governments in the West allowed individuals to own property and accumulate wealth. Then, after the wealth had been accumulated, the Western nation-states taxed a large fraction of it away… An election is, as HL Mencken described: ‘an advanced auction on stolen goods.’ The modern democratic welfare state combined the efficiency of private ownership and incentives for the creation of wealth with a mechanism to facilitate essentially unchecked access to that wealth. Democracy kept the pockets of wealth producers open.”—The Sovereign Individual

Mass plundering by democratic states continues today, and has been radically accelerated after the events of March 2020. As the economics of statism clearly indicate, US capitalism is now swiftly following in the footsteps of Soviet communism and speeding toward total insolvency. Once again, the financial obligations accumulated by the state are unserviceable by its current levels of revenue, which means taxation will necessarily be increased, creating incentives for people to escape this predation and shelter their capital by any means necessary. To this end, there is only one asset in the world totally immune to any state policy action or wealth redistribution effort—Bitcoin.

In 2021, the deterioration of the nation-state has never been more self-evident, and core to this transition into a new age is the neutralization of central bank confiscation enabled by Bitcoin. Free market forces are now, slowly but surely, stoking the surrender of statism to the ancient principle of inviolable property. Digital tools are quite simply better at rendering many of the services historically provided by the state; the end game of which is nation-state irrelevance. Nowhere is this more obvious than in the ascendance of ungovernable digital money—Bitcoin.

Sovereignism Disrupts Statism

Clearly demonstrated in the bankruptcy of the Soviet Union and the mega-politically charged collapse of the Berlin Wall is a fundamental economic reality: the greater assurances of property right inviolability market actors possess, the more wealth they will create. Using our forestry analogy, we could say that Soviet communism over-managed the “trees,” causing them to not bear as much “lumber” as they otherwise would. On the other hand, seeing more of the “forest for the trees,” US-capitalism involved a state less aggressive in its interventions early on, allowing free markets to self-organize and produce more “lumber” for later harvesting.

But what happens when the inviolability of property becomes absolute? One thing is for sure: with inflation eliminated as a revenue source and mechanism for “papering over” bad decision-making, nation-states will be increasingly held accountable by their constituents, in the same way customers hold all service providers to account.

Installing a central bank into an economy is the equivalent of putting its state overseer on anabolic steroids. Not only does centralizing control over the financial system radically increase the “legibility” of taxpayer activities, but it also exponentially decreases the cost of tax collection, as inflation becomes all too easy. A simple update to the single-node SQL database at the Federal Reserve known as the US dollar is all it takes to increase the money supply and rob those depending on the dollar as a store of value. Never before has such efficiency in the sphere of taxation been possible; modern technology affords nation-states an incredibly low-cost mechanism for mass financial predation via inflation. Deducting income taxes at source is another technology-enabled, cost-efficient form of taxation. But technology is a double-edged sword, and with Bitcoin (when used privately) sovereignists gain an ability to cloak themselves from the all-seeing eye of the nation-state. Even non-private Bitcoin holders are sheltered from the shadow tax of inflation. Armed with the cost-effective option to take final settlement at anytime, anywhere—the high portability of Bitcoin lets customers hold counterparties accountable for their actions, filling a role reminiscent of the global gold standard historically.

Central banking was implemented to interrupt the Analog Age regulator of state oppression: gold. Without an option to convert currency into gold or move capital out of a country, citizens become economically immobilized, making them decreasingly able to create wealth, and increasingly vulnerable to being hewn down by taxation. By hijacking gold—the automatic, free-market-check on state excess—central banking triggers a cascading escalation of state coercion, compulsion, and violence. Statism without monetary constraint is an imminently self-annihilating enterprise: accelerating violations of property push all market actors to adopt desperate measures. This explains why rent-seeking and swindling are so prevalent within state economies engineered under central banking. As Ayn wrote in Atlas Shrugged in 1957:

“When you see that in order to produce, you need to obtain permission from men who produce nothing—When you see that money is flowing to those who deal, not in goods, but in favors—When you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you—When you see corruption being rewarded and honesty becoming self-sacrifice—You may know that your society is doomed.”

As an escape from economic tyranny, Bitcoin is the “safe harbor” into which intrepid sovereignists seeking resistance to confiscation will sail as nation-state predation inevitably escalates. The states which come to understand the unstoppable incentive vortex related to Gresham’s Law will adopt Bitcoin at the expense of laggards. The net outcome of Bitcoin’s ascendency is the disruption of all statist revenue strategies premised on coercion, compulsion, fraud, and violence. For the same irrefutable economic reasons a more gradual degree of property right violations led to US-capitalism bankrupting Soviet communism, the absolute inviolability of Bitcoin as property will lead to those “businesses” (organisms, organizations, and states) which standardize themselves to it to outcompete all who refuse.

Bitcoin incentivizes antagonistic actors to conduct themselves as allies, at least economically, as the predatory business strategy of wealth confiscation is largely nullified by a property right that cannot be violated at the “turn of a dial.” In this way, Bitcoin is a major disruptor to all business models premised on the traditional state specializations of coercion, compulsion, and violence. Therefore, Bitcoin could prove to be one of the greatest forces for civility in human history.

States that survive this economic transformation will necessarily be those that recognize the self-defeating prospects of traditional statism, and choose to adopt the inviolable property basis of Bitcoin as their new paradigm. The miracle of Bitcoin is that it aligns economic self-interest with non-coercive enterprise. New Bitcoin “states” may emerge as a result of this disruption to traditional statist business models. With newly installed incentive systems, these “sovereignistic states” will be virtually unrecognizable through the lens of Analog Age statism. The traditional service lines of states—which depended on hapless and largely economically manipulable citizens—will no longer bear the “lumber” they once did. Instead, states will be forced to negotiate with citizens to reach mutually favorable terms, and will compete with one another to earn the business of prospective citizens.

States offering assurances as to the inviolability of property on par with the (digital gold) standard of Bitcoin will attract the best, brightest, and richest people into citizenship. Again, this principle of property is why communism fell to state-capitalism, and why state-capitalism is falling to sovereignism. To analogize statism to scientific forestry one last time: communism was a slash and burn, capitalism is a slower slash and burn, and sovereignism is the cultivation of unassailable “trees.” The major change in sovereignistic states will be that the “trees” are now free to negotiate the degree to which their “lumber” will be harvested. In exchange, taxpayers inhabiting sovereignistic states will demand quality service at an affordable cost.

At every scale of human interaction, Bitcoin incentivizes honest dealing, precisely because it is the most expensive form of property to violate in human history. Quite simply, Bitcoin makes coercion an uneconomic strategy. The repercussions of this will reverberate through all organisms, organizations, and states. Once again, the mega-political variable of technology is sufficiently altering the economic logic of violence in a way that will forever transform human civilization.

Property and self-ownership form the axiomatic substrate of socioeconomic sustainability. Finally, Bitcoin is opening the eyes of humanity to see this fundamental “forest for the trees.”

Thank you for reading Sovereignism Part 6: Strategy of Statism.

PODCAST

SOCIAL

SUPPORT

Send Bitcoin to my PayNymID: +tightking693

RECOMMENDED BUSINESSES

Subscribe to The Freedom Analects

Written works exploring truth, power, freedom, money, economics, virtue, sovereignty, philosophy, and other enigmas of existence.

Well worth waiting for, thank you!